The year 2024 has passed witnessing the resilience of Pakistan startup ecosystem amid persistent challenges, reflecting gradual recovery and potential for growth. The year began with a dry first half, largely impacted by global VC funding constraints and domestic challenges. According to S&P Global Market Intelligence, Q2 2024 saw an 8.3% YoY decline in deal value and a 14.3% drop in the number of transactions. This downward trend persisted into Q3 2024, with a further 7.8% YoY decline. Despite these headwinds, Pakistan’s VC funding landscape began to show signs of recovery, supported by stabilizing economic conditions and renewed investor confidence.

Economic Recovery

Pakistan’s economy showed steady recovery in 2024, mostly from the 2nd half of the year, supported by the IMF’s approval of a $7 billion Extended Fund Facility (EFF). The progress was further strengthened by a significant 900 basis point policy rate cut by the SBP, as inflation eased to 4.9% in November 2024 (6.5-year low) and stable USD/PKR exchange rate. The country’s improving fiscal and external account positions along with government’s initiation of structural reforms efforts, resulted in upgraded credit ratings with a Positive outlook from international agencies reinforcing investor confidence further.

Startup Snapshot 2024

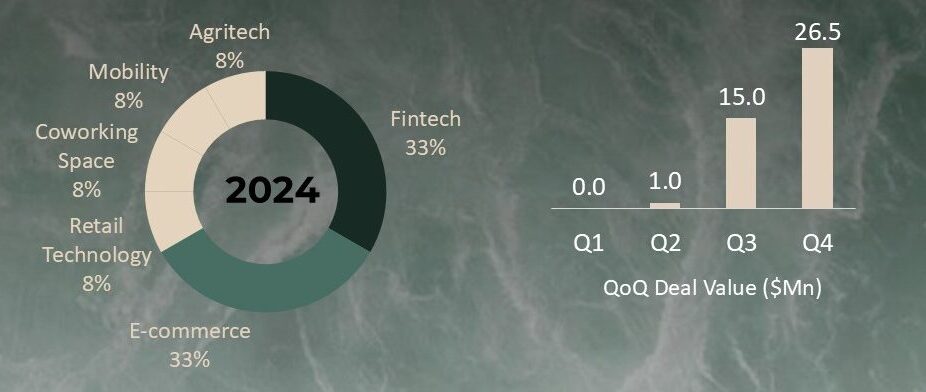

In 2024, twelve startups announced funding rounds, bringing the total funds raised for the year to $43 million, with average deal size increased by 80% YoY. Notably, startup funding experienced a significant surge of 77% QoQ in Q4 2024, with four deals collectively raised $26.5 million, accounting for 62% of the total deal value. The growth has instilled renewed confidence in Pakistan’s startup ecosystem. E-commerce and fintech emerged as the primary areas of investor interest, reflecting their strong growth potential in a country characterized by a large population and relatively low levels of financial inclusion. A shift towards credit-based fundraising was evident, accounting for 25% of total deals, alongside strategic investments, such as InDrive’s notable funding of KraveMart, signaling evolving trends in the funding landscape.

Startup Funding Snapshot CY24

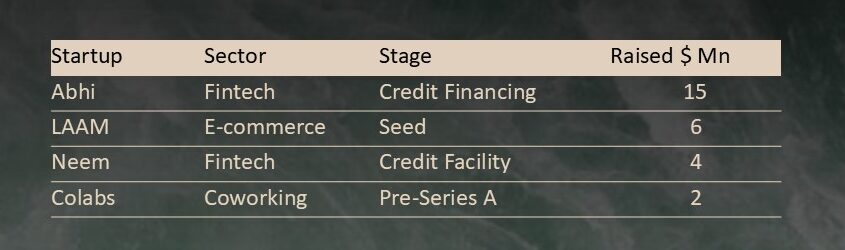

Top Deals Q424

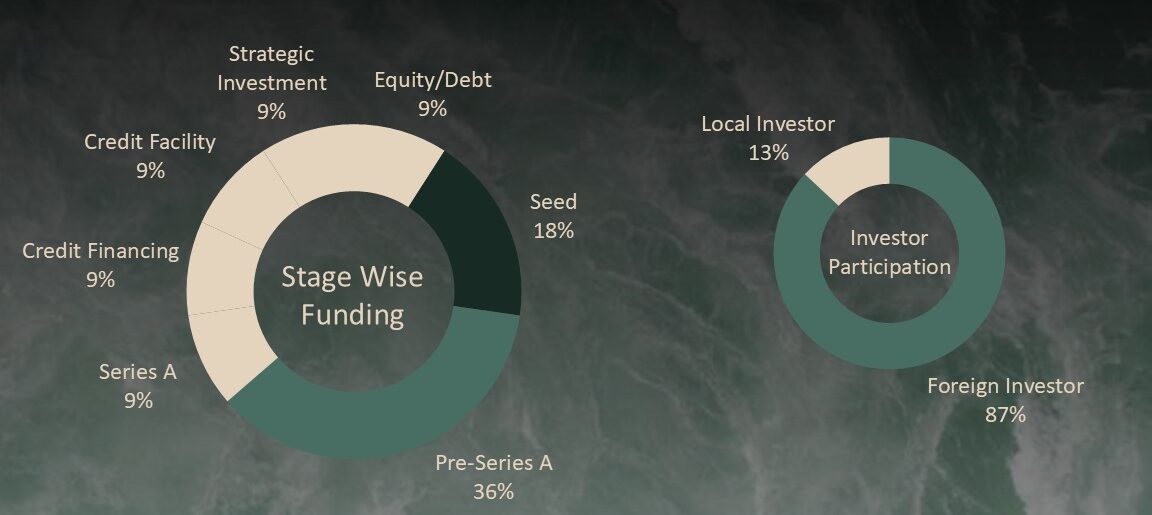

A significant shift towards late-stage funding was observed, with Pre-Series A and Series A rounds accounting for 45% of total deals in 2024 compared to 86% of the deals dominated by seed and early-stage funding in 2023. The trend highlights a growing investor preference for supporting more mature and scaling startups. In addition, total foreign investors’ participation was 87% in startups for the year, as compared to 81% last year.

Stage Wise Funding (left), Investor Participation (right)

IPO Market revived in 2024

The IPO market also experienced a notable resurgence in 2024, with seven IPOs launched compared to just one in the previous year. These IPOs collectively raised over Rs. 8 billion , further supporting the trend shift from early-stage investments to more mature late-stage deals. Additionally, Pakistan’s equity market was recognized by Bloomberg as the world’s 2nd best-performing stock market in 2024, underscoring the growing confidence investors have in the country’s economic prospects.

Rise of M&A activity in 2024 – FDI on the rise

In line with macroeconomic recovery and stability, Foreign Direct Investment has been on the rise as well, with 31% growth recorded in FDI during 5MFY25 (Jul-Nov24) to $1.12 billion. 2024 also marked a significant year for Merger & Acquisition (M&A) activity in Pakistan, driven by a remarkable increase in transactions across various sectors, including power, oil marketing, and technology. Mature conglomerates played a pivotal role in this surge, particularly in the power and oil marketing sectors. Key transactions included Gunvor Group’s acquisition of Total Parco Pakistan Ltd, Saudi Aramco’s acquisition of Gas & Oil Pakistan Ltd, and Wafi Energy’s acquisition of Shell Pakistan, reflecting strategic moves for business expansion. In the renewable energy sector, Dubai-based Juniper International FZ LLC acquired shares in Reon Energy to enhance its portfolio, capitalizing on Pakistan’s growing demand for solar energy solutions.

The wave of M&A activity was not limited to established players. Startups, facing a challenging fundraising environment, also turned to M&A as a strategic avenue for scaling operations and driving growth. Noteworthy transactions included the acquisition of Sadapay by Turkey’s largest fintech, Papara; the acquisition of Trikl, a Pakistani wealth management startup, by Elphinstone; and a strategic investment by InDrive in Kravemart. Foreign interest in acquiring stakes in Pakistan’s business has increased, reflecting growing investor confidence in the country’s business potential.

M&A Activity Snapshot CY24

Initiatives to Boost Startup Funding

In response to the decline in foreign funding, the government introduced the “Pakistan Startup Fund” with an allocation of Rs. 2 billion, aiming to stimulate investment in innovative IT projects and promote local capital growth. Additionally, Gobi Partners, a pan-Asian venture capital firm, launched the $50 million Techxila Fund II and signed a Memorandum of Understanding (MoU) with the Bank of Punjab (BoP) to further strengthen Pakistan’s startup ecosystem.

Driving Growth: Global AI Funding and Pakistan’s Emerging IT Landscape

Global venture funding reached $28 billion in November 2024, with over half directed to AI, peaking at $14 billion. Pakistan is on a similar path, with IT exports growing 25% to $324 million in November 2024, targeting $25 billion during next three years, reflecting the competitiveness and quality of the work produced by Pakistan’s tech enterprises and freelancers. In addition, government is taking initiatives like the Skills Development Programme under PMYP to equip youth with in-demand skills such as AI, programming, and data analytics, fostering global competitiveness. It highlights that with the right investment, the AI and IT sectors have the potential to become major contributors to startup funding in Pakistan.

Way Forward

The year 2024 highlighted the resilience of Pakistan’s startup ecosystem, showcasing a gradual recovery amidst global and domestic challenges. Increased activity in startup funding, IPOs, and M&A, particularly in late-stage funding, underscored evolving strategies for growth and scalability, driven by stabilizing economic conditions and renewed investor confidence.

Looking ahead into 2025, the positive momentum from 2024 is expected to continue, in key sectors of Fintech, E-commerce, Healthtech, Edtech and AI. Anticipated political and economic stability, bolstered by marked decline in default country risk, reduced cost of capital, decline in inflation and stable currency parity, improved global investor confidence with growth prospects setting in, the investment environment is likely to attract both local and foreign investments.

Nerizel is a finance enthusiast with a Bachelor’s degree in Business Administration, specializing in Finance. She is committed to leveraging her analytical skills and financial acumen to excel as a financial analyst.